The First Payment Services Directive was groundbreaking in Europe, enabling the European Commission’s vision of a Single Euro Payments Area. The second iteration, PSD2, arguably had an even greater impact on banks globally, creating the foundations for open banking, and the use of APIs, which are now widespread around the world. So why are the regulators creating yet another version, and what might it mean?

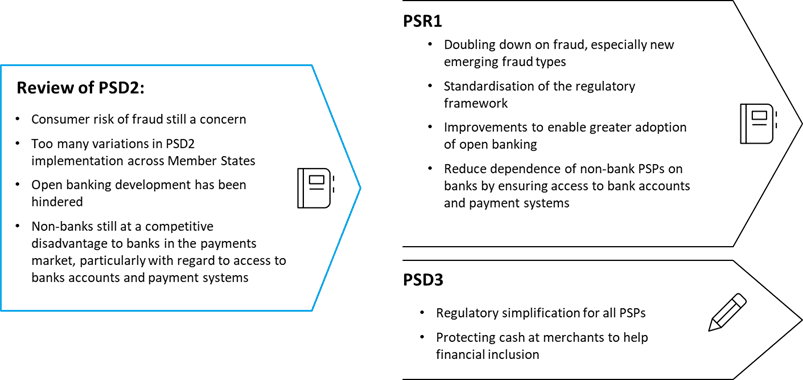

The answer is complex. Rather than just an update, a number of directives in adition to PSD2 are being brought together to create a different set of directives and regulations, most notably PSD3 and PSR1, the Payment Services Regulation. This aproach aims to both harmonise how different actors in payments are treated, but also level the playing field for some. Yet they go further, and in particular double down on the fight against fraud and enabling open banking. For banks operating in Europe, there are many implications and things to start planning for. Yet banks outside of Europe should also pay close attention as many elements of PSD1 and PSD2 are now present in many markets around the world.