Financial crime compliance operations are plagued with perhaps the most severe efficiency and accuracy issues in financial services. Fortunately, new technology is available to help. Machine learning, AI, natural language processing, and now generative AI tools can support more accurate financial crime detection and increase efficiency in investigative processes. Celent estimates the need to leverage next-generation technology to improve compliance outcomes will drive financial institutions to prioritize strategic investments to improve the efficiency and accuracy of AML.

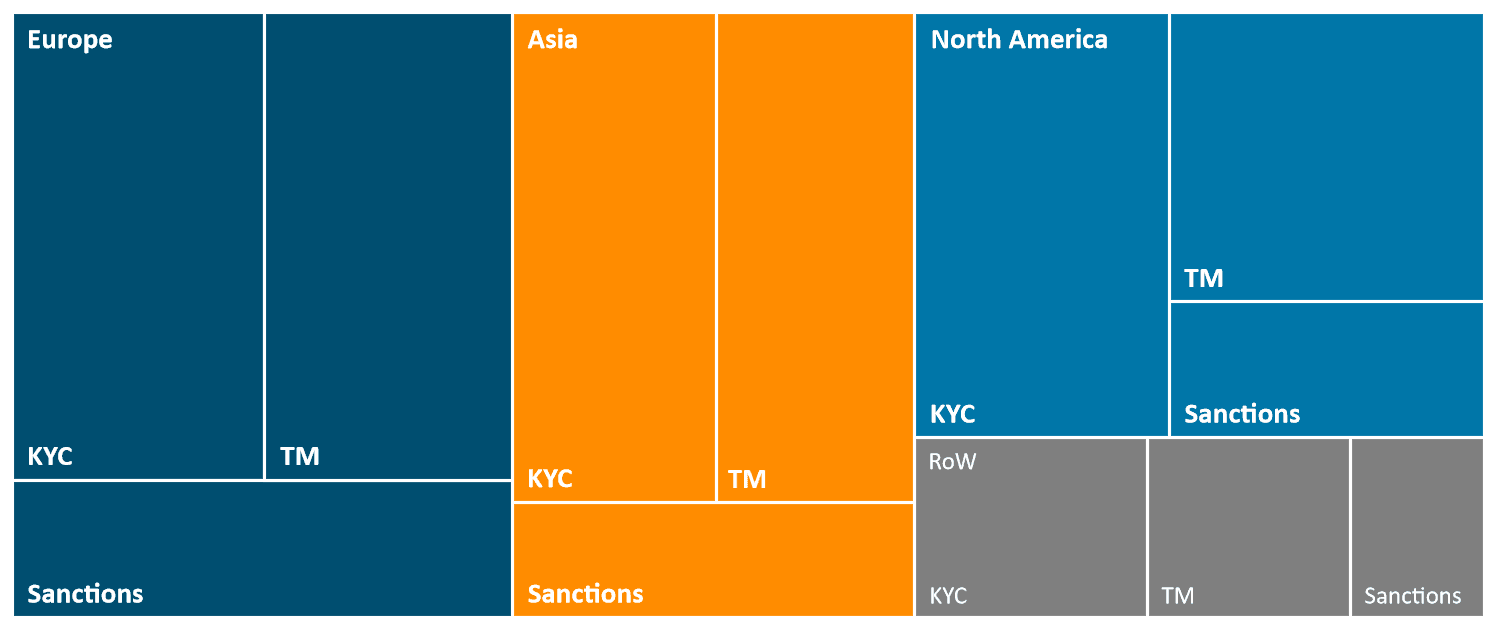

This report, based on data from the Celent Technology Insight and Strategy Survey (CTISS) survey undertaken in 2023, provides our estimates of investments in financial crime compliance technology—as well as operational spending on financial crime compliance—by financial institutions worldwide, including banks, insurers, broker-dealers, and wealth and asset management firms. The report presents global estimates and breakdowns including: