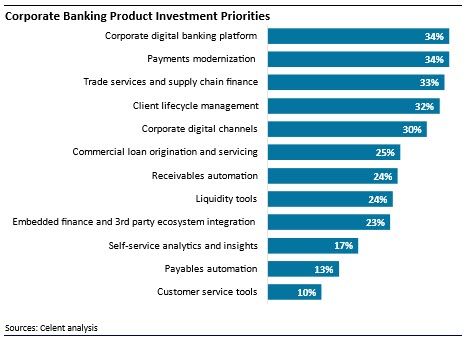

Since the financial crisis, transaction banking and commercial lending have become essential revenue streams for banks, characterized by low capital costs and significant investments in technology infrastructure to cater to the complex needs of corporate clients. However, recent interest rate cuts by major central banks are reshaping the financial landscape, leading to a slowdown in transaction banking revenue growth. In this competitive environment, the quality of digital experiences is increasingly critical for client retention and product adoption. Despite rising IT investments in corporate banking, a limited portion is directed toward growth initiatives, highlighting the need for strategic prioritization. With such a limited pool of funds, banks must make tough decisions about trade-offs between critical client-facing solutions. Corporate digital banking platforms continue to be the top investment priority, closely followed by corporate digital channels, terms that are often used interchangeably.

Digital channels are central to banking services, offering operational improvements and enabling new services, while businesses seek partners that provide a balance of high-tech solutions and high-touch advisory services. Celent's ongoing research into corporate digital banking platforms reveals significant innovations in delivery channels and product areas, emphasizing the importance of corporate-to-bank connectivity for businesses operating globally. As banks increasingly focus on user interface design and client engagement, they face challenges in funding product enhancements amid tighter budget constraints. The decision to buy or build digital banking platforms hinges on existing capabilities and the need for modern architectures that are flexible, scalable, and secure. Leading banks must navigate these trends to modernize their corporate digital banking platforms, ensuring they are equipped to meet the evolving demands of the market.

Banks mentioned in this report: Bank of America, Citi, Citizens Financial Group, DBS Bank, Deutsche Bank, HSBC, J.P. Morgan Chase, RBC Clear, Silicon Valley Bank (a Division of First Citizens Bank), Techcombank, and U.S. Bank